Newly published report, 2016 Venture Finance in Africa Research by VC4Africa reveals there is a growing international and local angel investor interest in early stage startups in Africa. That is to say investors, from both within the African continent and outside Africa have a growing confidence in startups emanating from Africa.

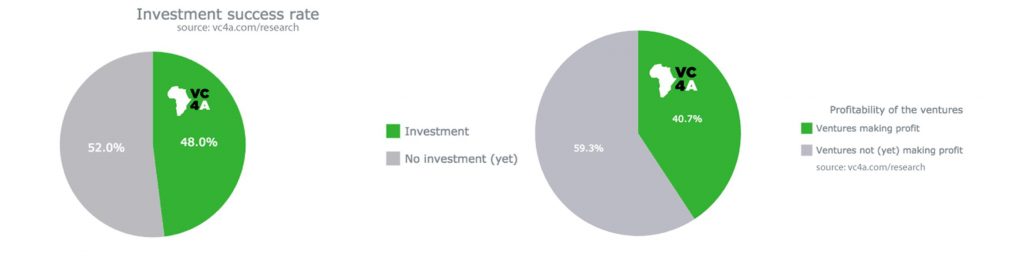

Total invested capital more than doubled compared to last year’s data: from almost USD 27 million to USD 73 million, secured by 224 ventures who took part in the survey (48% of total). The average amount invested per venture also increased from USD 200K last year to USD 326K.

Insights

The VC4Africa ‘Venture Finance in Africa’ report captures the performance of early stage, high growth ventures from Africa and the activity of early stage investors. The insights are broken down across five indicators: job creation, financial performance, investments, early-stage investor activity and ecosystem.

VC4Africa co-founder Ben White explains why this annual research is conducted: “Operating as a founder or investor without quality information hinders your ability to make informed decisions. A critical challenge for those venturing in Africa. At VC4Africa we are working hard to address this. The members have come together to establish a basic index that starts to put real numbers behind Africa’s growth story.”

Annual research among entrepreneurs and investors

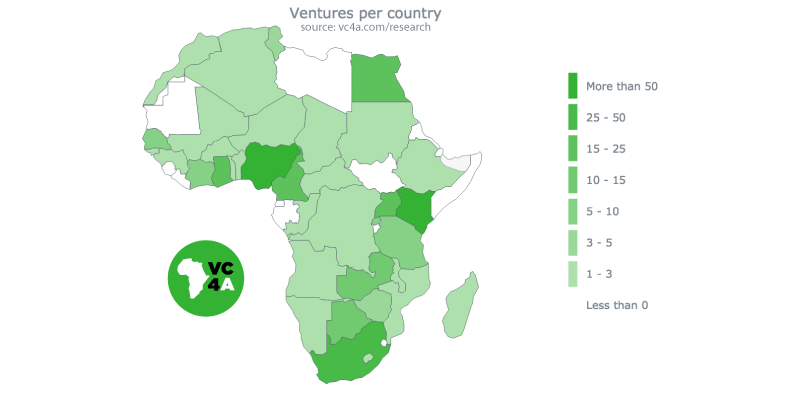

This is the third time VC4Africa has endeavored in this annual research. As of September 2015 the data collection takes place continuously via the VC4Africa portal. The 2016 release is based on data collected in 2015 from 462 ventures from 41 African countries (see chart below) and 140 Africa-focused investors from 25 countries around the world. As the community continues to grow, it is expected the report will generates insights into what is happening across the larger startup space.

Performance over time

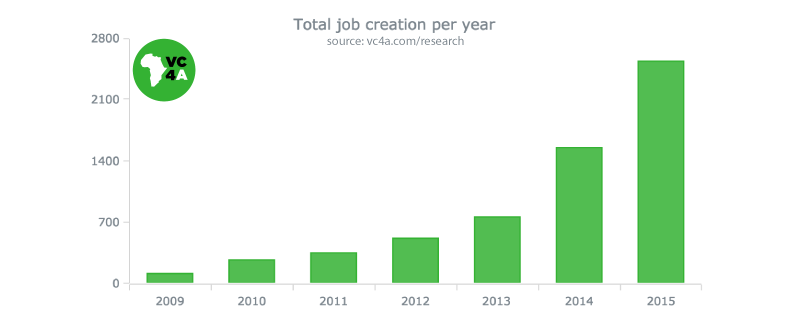

Innovative ventures yield high social and environmental impact and are a key driver for Africa’s development. Opportunity driven entrepreneurs are generating much of Africa’s employment, income and hope for a better future. But how are these companies progressing over time?

Datasets on this emerging segment are limited and there are few comparative studies. This research initiative feeds the creation of the African Venture Performance Index, a leading benchmark for the industry.

Top investment categories

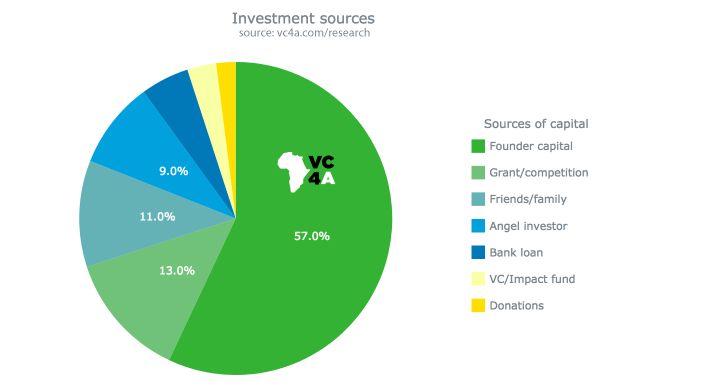

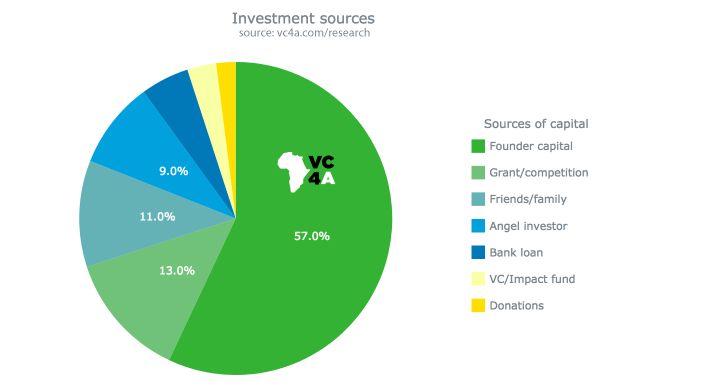

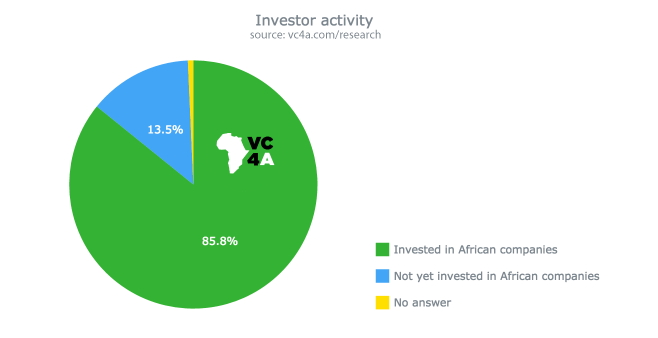

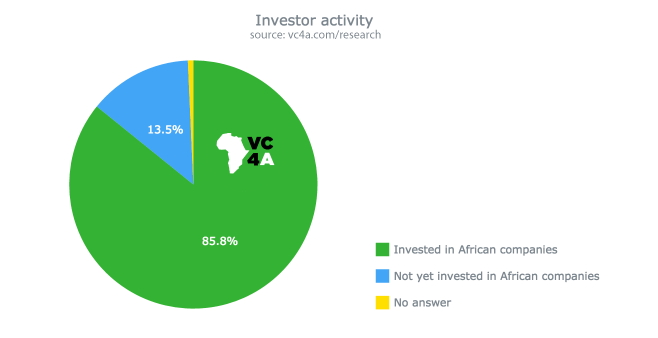

The research shows top investment categories are related to the Technology sectors, and then followed by Agriculture, Health, Finance and Energy. The research also reveals that ventures that participate in sector events, or join an incubator or accelerator, are twice as more effective in securing capital for their venture. And of the investors part of the VC4Africa community 86% has invested in an African venture.

VC4Africa Research Lead Thomas van Halen was not surprised to see 86% of the participating investors is/has been investing in African startups, which is similar to last year’s results. “I was mainly intrigued to discover the high amount of new investors in the market with less than 5 investments. This implies they are building up their investment portfolios in the near future. One way to do this can be the formation of more -local- syndication opportunities.”

For more information about the Venture Finance in Africa research initiative visit: https://vc4a.com/venture-finance-in-africa.