When talking about China and Africa’s relationship, the first thing that comes into the mind of most people is the Chinese government funding of infrastructure projects in Afric. While that has been true going back a number of years now. The year 2019 has seen the Chinese private investors go full throttle on a different kind of investment opportunity on the continent; the African startups scene.

Notably, the three African startups OPay, PalmPay, and Lori Systems, who combined, have received a total of $240 million in venture capital funding from Chinese investors.

OPay

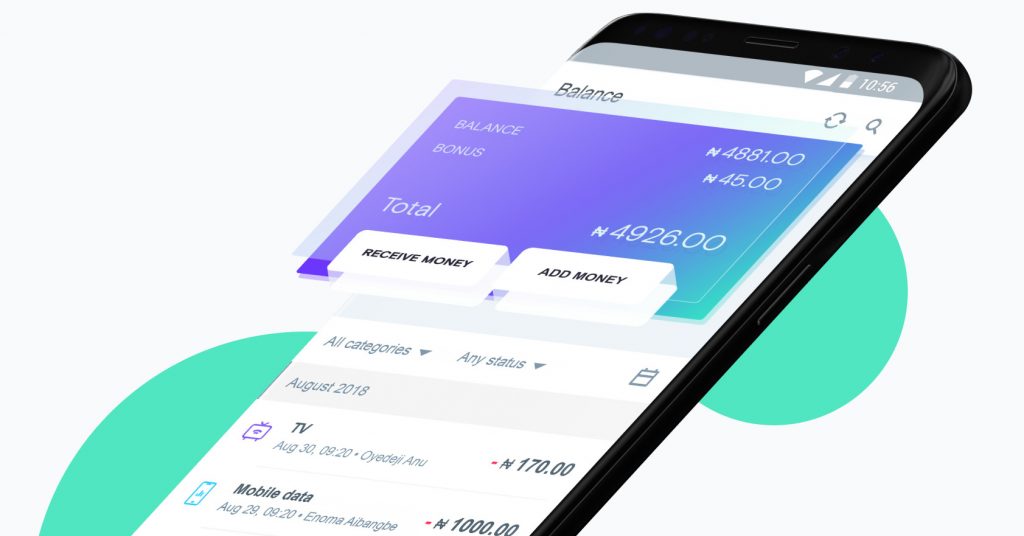

Opay is a payment solution developed by Opera Software to provide efficient financial services to about 60% of African populations who remain unbanked or underbanked. With OPay, users can send and receive money, also do online shopping from the OPay mobile app or web browser integration in the Opera browser.

OPay operates as a subsidiary of Opera Software, which is now owned by a consortium of Chinese investors. More on that in this previous article. OPay also doubles up as an e-wallet where users can choose to keep their money.

PalmPay

PalmPay is another payment solutions startup backed up by Chinese mobile-phone maker Transsion, China’s NetEase, and Mediatek. It is a mobile-based financial service that enables users to make payments and utility bills at zero fee charge. The system rewards users for each transaction with things like discounted airtime.

Lori System

Lori System is a Nairobi-based on-demand trucking logistics company out to disrupt the cargo transportation industry on the continent. Experts say that the relative cost of moving goods within East Africa is the highest the world over. 75% of the cost of a product is attributed to logistics, while in the US that falls down to just 6%.

The $240 million funding to the above three startups was from 15 different investors from China. These investors have been keeping tabs for a while on the African startup scene. Experts agree that 2019 has seen the highest interest in the tech startup scene in Africa by Chinese investors.

The interest in the African financial services space is riding on the fact that about 60% of the 1.2 billion people are either underbanked or unbanked. That coupled with the fact that the continent is rapidly adopting smartphone and mobile internet connectivity providing an infrastructure for rapid FinTech innovation. Thereby leapfrogging the conventional banking system development and adopting cutting-edge mobile-based fintech services.

That is why fintech startups are mushrooming all over the continent in their hundreds, and investors are noticing investment potentials. According to a report by WeeTracker, the fintech industry gets the lion’s share of VC capital funding and deal-flows coming to the continent.

Kenyan B2B Agri-Tech Start-Up Taimba Gets $ 100K in Funding from Gray Matters Capital’s coLABS