If you’re from or in Kenya, then you have probably found yourself paying for a good or service using the country’s most popular mobile money service M-Pesa and did not have enough money in your mobile money wallet. Then Fuliza is the new service from Safaricom you will love using.

Safaricom confirms 58% of payment via Lipa na M-Pesa services (PayBill and Buy Good) do not take place in the first instance because the user did not have enough funds. That will pretty soon be a thing of the past; all thanks to Fuliza.

Fuliza is a new overdraft facility on M-Pesa that will allow you to make a purchase under the Lipa na M-Pesa service when your balance is less than the required amount to satisfy the transaction. Previously, trying to make a transaction with insufficient fund the transaction will not go through, and instead you will be met by a message informing you that you have less balance.

With Fuliza, the transaction will go through and the excess amount registered as an overdraft to your account. You will have 90 days to repay the overdraft at a daily interest of 0.5%. The overdraft amount is being provided by the CBA Bank. Users can access Fuliza by dialing the USSD code *243# on their phone or using the mySafaricom app.

How to use Fuliza service

You are not enrolled into the Fuliza service by default, which is a good thing since you don’t want to find yourself going on overdraft on your M-Pesa without your knowledge. The user has to actively enroll themselves onto the service.

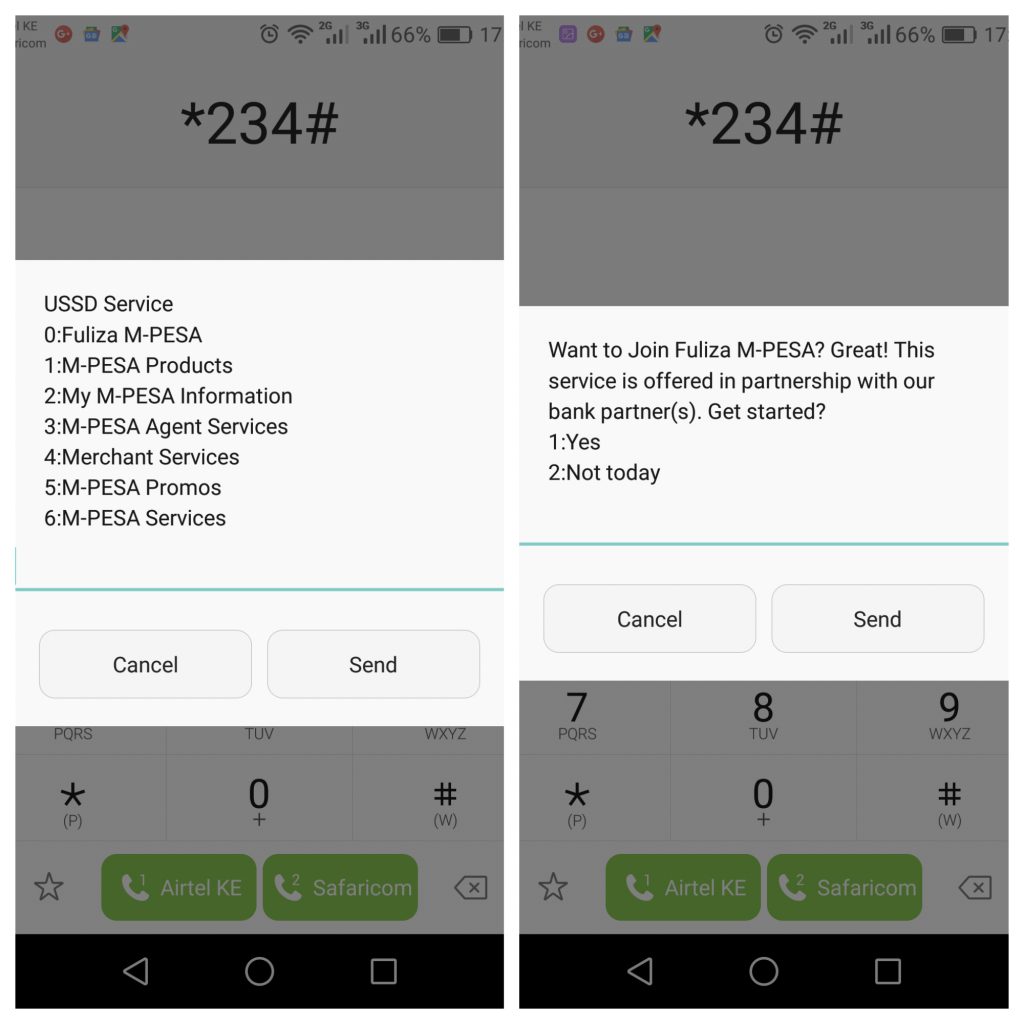

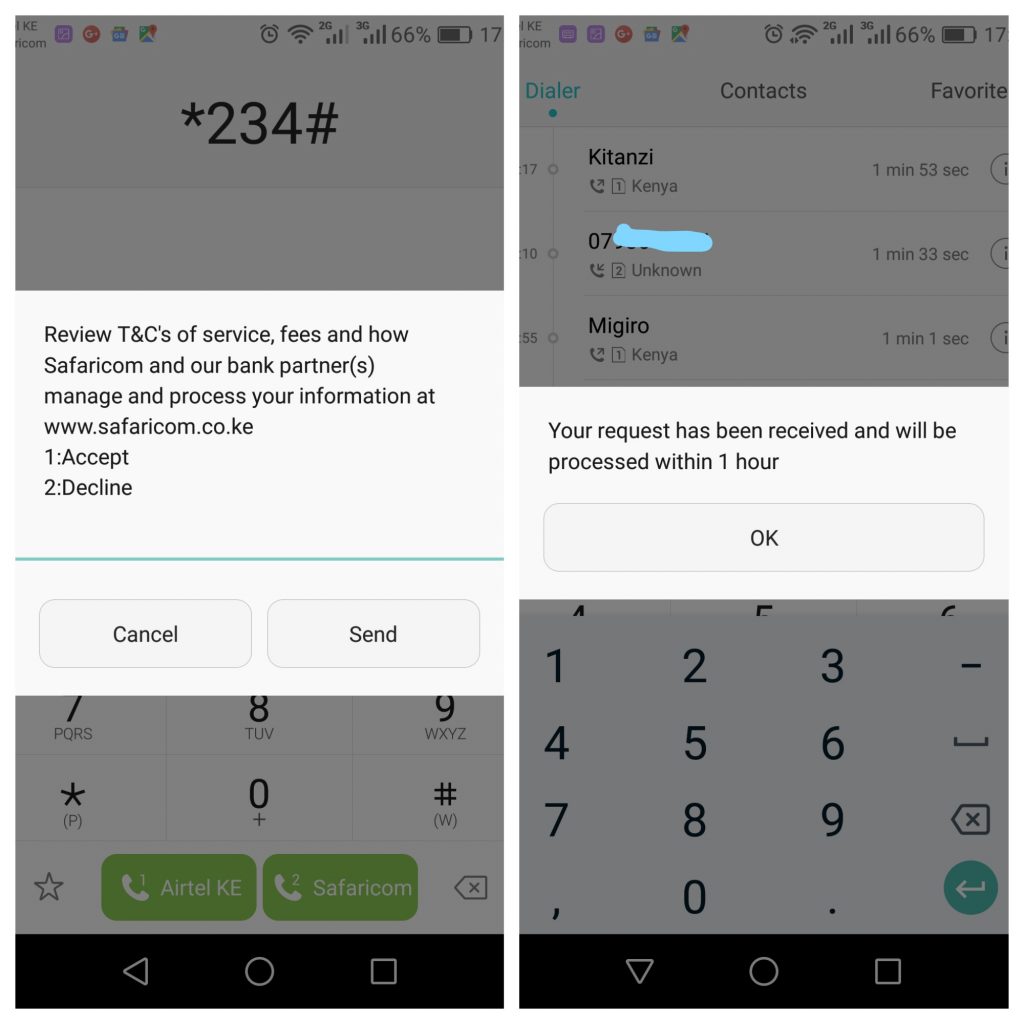

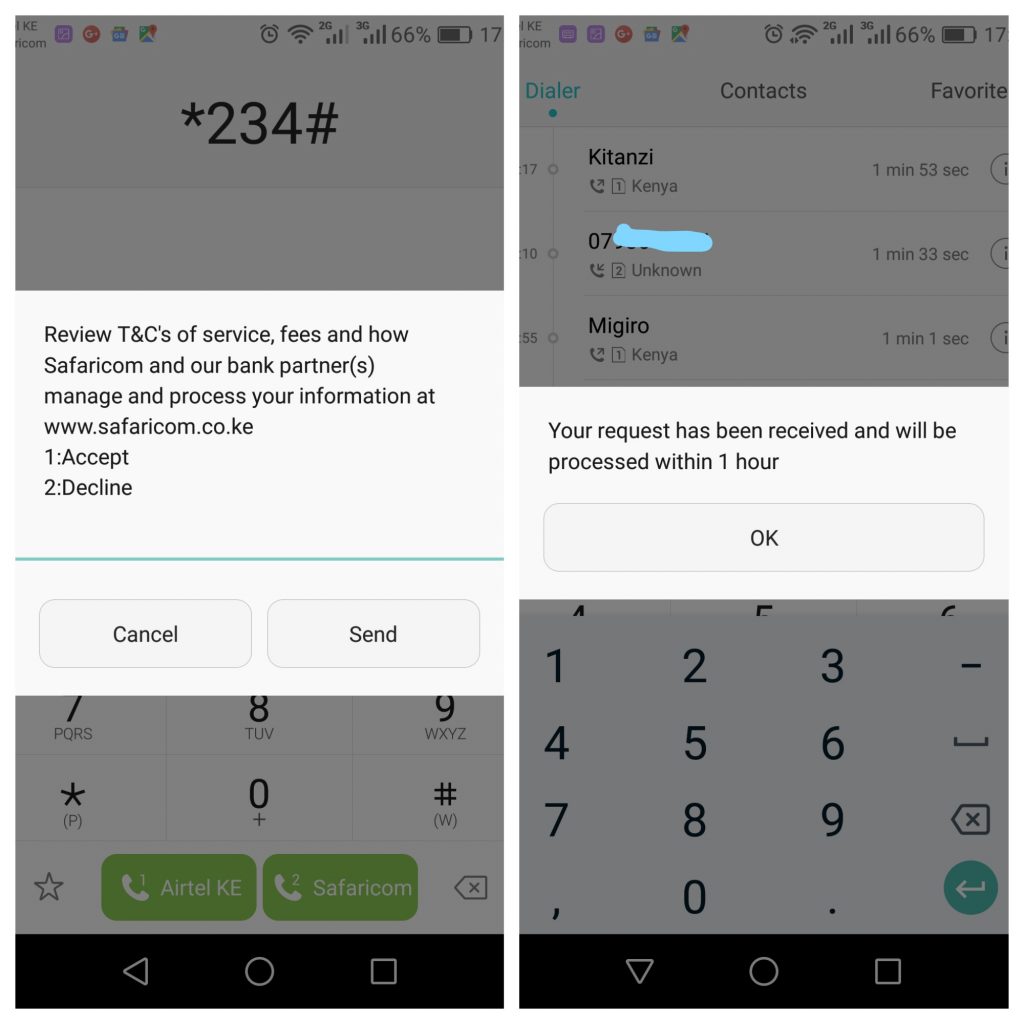

Simply dial *234# on your phone and you will be met by the following screen prompts.