Travelers found to favor mobile payments as industry players embrace the fast-growing trend.

The growth of mobile financial services in Kenya has created quite a buzz across continents in the last few years; with analysts placing the exponential sector way above ‘conventional’ banking services as more and more people embrace the wave of convenience. Opinion leaders continue to attribute this growth to its convenience and accessibility, cost-effectiveness and the security guaranteed by cash-less trading.

A report released by the Communication Authority of Kenya valued mobile payments in the first half of 2015 at KSh 1.3 trillion; a notable growth compared to KSh 1.1 trillion through the same period in 2014. This places the country on the top of the pack in the Sub-Saharan region.

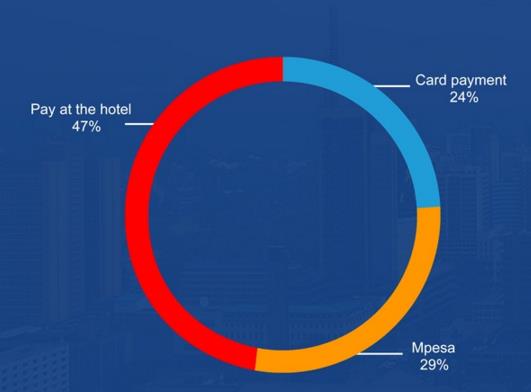

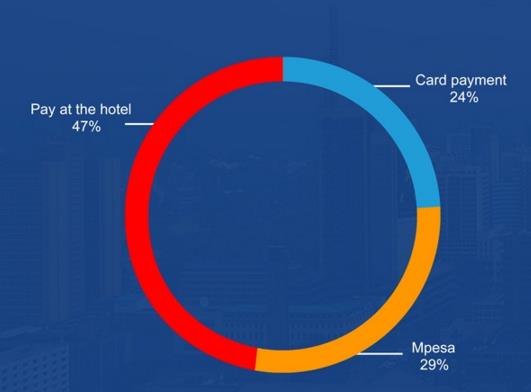

The Kenyan hospitality industry has not been left behind either, in a recent report launched by hotel booking site, www.jovago.com, mobile payments appear to gain more favor at 29% of as compared to card payments at 24% of total customers who used the site in the first half of 2015.

“The sector is going through a profound transformation as consumers drive the demand for one-stop-shop kind of convenience” says Cyrus Onyiego, the Country Manager at Jovago. “Mobile payments are taking over the sector, as different suppliers on the chain steadily shift from conventional platforms to embrace this growing trend”

Apart from bolstering a customer-centric environment, m-payments are also presenting a unique gain to the suppliers by hugely cutting on transaction costs; this in turn lowers the total operating cost for businesses thereby driving revenue while maintaining efficiency.

But this, unlike many technology-driven innovations seem to be created by an actual demand; creating a bank of sorts for he ‘unbanked’ and in environments where other financial services are either inaccessible or simply unreliable. The most outstanding aspect of mobile banking/payments is that it transcends the need for sophisticated operation systems and applications to perfectly function on basic feature phone models.

According to a recent report by Technology and ICT provider Ericsson, Africa is fast approaching the 1 billion mobile phone subscriber mark; having recorded 910 million users in the the first half of the year. The report brings to attention the rapid growth well reflected in an impressive 21 million new mobile subscriptions in the first quarter alone.

As mobile payments become more popular in the sector, it is important for merchants to adopt supportive practices that will enhance ease and speed of use like creating Paybill and Business number for their property as well as pass this information to OTAs and third party agencies.

Creating loyalty through incentives such as discounts for items purchased via mobile, launching interactive apps and generally being in reach will all go a long way in promoting this. The option must also be cheap, safe, easy and accessible as compared to other conventional service for any guest to consider it as a viable and better option.