If you read any newspaper, financial website, or paid any attention to the recent Federal Reserve meeting, the talk has been predominantly centered around inflation.

Over the last several months as the economy has reopened, a lack of workers and continued supply shock has sent the consumer price index skyrocketing, increasing already out of control inflation fears.

Combined with unprecedented influx to the global money supply, risk of hyperinflation is on the minds of investors who have begun to de-risk across the stock market and crypto. But much like how any financial market works, when there’s fear, it can also be a time to be greedy.

Here’s how to trade based on inflation fears, and a list of assets it is time to be greedy on.

Trading Fear And Greed

“Be greedy when the market is fearful,” or “buy the blood in the streets.” Quotes and stories of contrarian traders making millions are commonplace, yet going against the market trend is often the most challenging task.

The likes of President JFK’s father spotted tops of markets when the shoeshine boy was handing out stock tips, but times have since changed. Markets are more open than ever before, and the pandemic got regular folk involved in crypto and meme stocks.

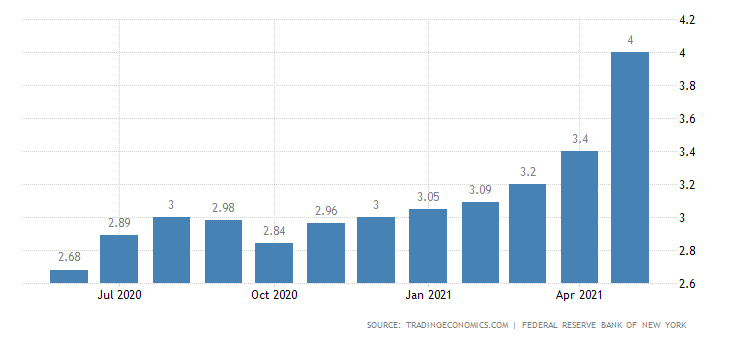

Looking at data that represents the masses, and not just one small sample is a lot more effective in analyzing trend changes. Which is why looking at the spike in the inflation expectations across the United States, it could signal a major change in markets – especially around risk.

Inflation Expectations Skyrocket

April 2021 saw the highest inflation expectations in years. At the same time, the crypto bull market came to a crashing halt, and the stock market is now stuck around local highs for months on end.

There is clearly correlation between the rise in inflation expectations and the subsequent market selloff. And this can all be tied to the Federal Reserve’s seemingly hawkish stance. During recent meetings, the Fed said it would begin to raise interest rates in 2023 – two years from now. Yet the market reacted in a big way.

Rising interest rates means less access to cheap cash, which means less leverage in the market, less interest and trading volume, and of course, falling asset prices. Assets selling into cash gives the guise that the dollar is turning around and inflation isn’t quite as bad.

Counter-Trade Fear With Value

However, all while this happens, there’s a capital rotation going on. When markets get risky, investors turn from growth to value, and move their money into something that performs less powerfully in the short-term, but has less chance of succumbing to losses over the long term than other assets.

This means that to counter trade inflation, one has to also move from growth to value. Growth to value is hard to define, but historically, value has been focused around gold, silver, commodities, and any asset with a lower supply.

High-risk assets like stocks and cryptocurrencies could suffer. Gold trading interest has disappeared over the last year, but could soon resume in a big way once the shift in sentiment is complete.

The big question mark remaining is instead around Bitcoin, which has never faced a real recession. The closest glimpse of that was on Black Thursday and the asset collapsed back to $3,000. Could the same happen again? Or is the recent pullback similar to what’s going on in precious metals, where investors are accumulating the assets for the hyperinflation that’s possibly ahead?

Trade Gold And Bitcoin With PrimeXBT

Gold trading is one of many ways to take advantage of the trend change before it happens. Bitcoin is also consolidating at recent lows, and after a 61.8% fall – a key Fibonacci level – the leading cryptocurrency by market cap could also soon turn back around.

The stock market has been in a secular bull market for nearly one hundred years, propped up by stimulus money and smoke and mirrors. When the smoke fizzles out and the dust settles, the stock market could be without gains for many years to come.

PrimeXBT is an award-winning margin trading platform with both CFDs on crypto and precious metals, as well as stock indices, commodities, forex, and more. With the world on the cusp of more financial shakeups, having access to so many markets under one roof will prepare any trader for whatever is to come – inflation, rising interest rates, or something else entirely.