When it comes to mobile money, Kenya is leading, and the rest of the world is playing catch up.

As M-Pesa (coined from the Swahili word ‘pesa’ meaning money) celebrates its 10th anniversary come March 2017. The United States and indeed other parts of the developed world regions have just started using smartphone payments solutions; Apple Pay, Samsung Pay, Facebook Messenger payment and Google Wallet among others.

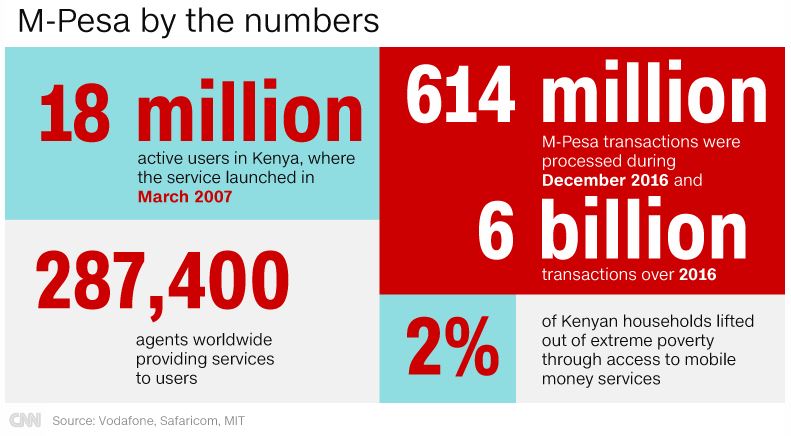

Mobile payment has been in existence in East Africa for a long time now, and the majority of the population uses one form of mobile money or the other, with M-Pesa being most popular. The service was launched by Vodafone (a stakeholder in Safaricom) in 2007 as a simple payment solution. Given the majority of the population in Kenya don’t have bank accounts and can’t use traditional banking services as payments solution.

Today, M-Pesa boasts of over 30 million users across 10 countries and a wider range of services including the ability to pay utility bills, savings accounts, loan services, international fund transfer, and health provision. Last year, M-Pesa reached a peak rate of 529 transactions per second with a total cash handling of about 6 billion.

How M-Pesa is helping SMEs

Much praise is being given to M-Pesa for making the business environment easier and safer to operate for small businesses. It also plays a significant role in reducing poverty by providing a convenient mean for direct cash transfers.

The Challenges M-Pesa is facing

The mobile money has tried launching into the South Africa market, but it failed so miserably it had to be withdrawn completely. The service flourishes in markets where traditional financial institutions (such as banks) fail to include a large number of the population in its services, coupled with the existence of a supportive macro environment. In South Africa, the banking services are mature and include a larger percentage of the population, thus no vacuum for M-Pesa to fill.

In countries where the service got traction, other competing telecoms have introduced their mobile money services, and more often than not at more affordable charges. Even, banks are ganging up against M-Pesa and launching their competing mobile payment service, with Kenya Equity bank’s Equitel being the best example.

Safaricom celebrates M-Pesa’s 10th Birthday with introduction of Lipa na M-Pesa Cards

Safaricom has given out some 16,000 Lipa na M-Pesa cards in a pilot project to see M-Pesa services could slide deeper into conventional banking services.

“We are currently analyzing data and feedback generated during the pilot stage to improve users experience before we do a formal launch this year,” said Sylvia Mulinge, the Safaricom consumer business unit director.