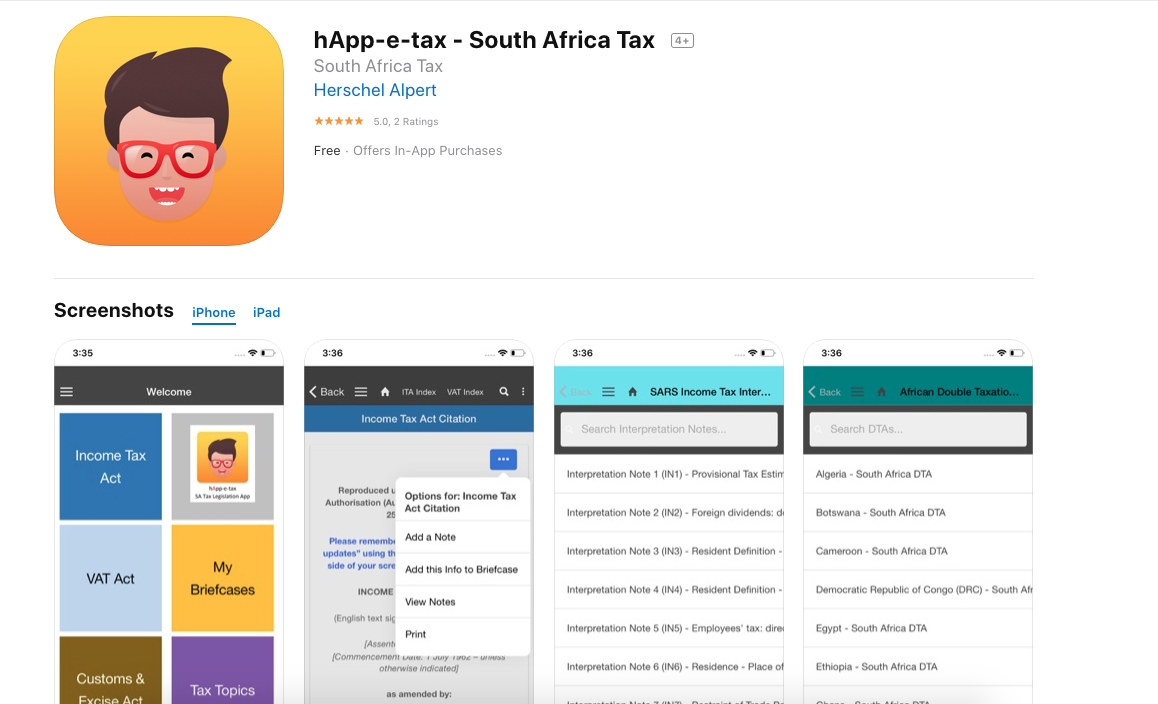

An innovative new VAT app, developed by a tax expert at hApp-e-tax, is now available in South Africa and is the mobile answer to VAT queries for accountants, auditors, tax practitioners, lawyers and even entrepreneurs who don’t have access to specialized teams. This simple-to-use tech innovation will make it easier for those who need to navigate through heaps of content to fully understand and apply South African VAT legislation.

The app includes the VAT Act, Customs and Excise Act, Securities Transfer Tax Act, Estate Duty Act and Transfer Duty Act. In addition, users will find all the SARS published rulings and can even print directly from the app. With quick turnaround times on revisions of the acts and legislation, the app is updated immediately when new tax legislation or SARS information is introduced.

Explains Herschel Alpert, CEO of hApp-e-tax: “It’s a major step forward from the hard copy books and online searches that have been available till now when searching for VAT information.

Explains Herschel Alpert, CEO of hApp-e-tax: “It’s a major step forward from the hard copy books and online searches that have been available till now when searching for VAT information.

I was inspired to develop this VAT app after the success of the hApp-e-tax income tax app which was released two years ago. With a great adoption rate and positive feedback, we had numerous requests to offer VAT and other indirect taxes, and with a few enhancements, we have managed to deliver exactly that.”

Among the industry’s key users are two of the ‘big four’ audit firms who have had great success with the hApp-e-tax income tax app, reporting that the advanced technology has transformed the way they consult.

The app provides comprehensive information, which is simple to navigate, with an intuitive search engine that can be accessed even without an internet connection.

Providing all the tax information needed in one app, this smart tool has seen thousands of downloads for both IOS and Android stores for mobile use on Apple and Google smartphones and tablets.

Senior tax director at Werksmans Attorneys, Michael Honiball says, “Our team of tax professionals use the hApp-e-tax app daily, with all the tax information available needed in the palm of our hand. It’s a tool that no tax professional should be without.” Other users have commented that the hApp-e-tax app provides accurate information at high speed making the best use of consulting time.

Alpert understands the industry’s requirements having worked as a tax consultant and knowledge manager at two global auditing and tax consulting firms in South Africa. The VAT app is set to change the face of good corporate governance beyond the accounting, audit and legal professions and will raise service standards in South Africa.

Users can try the hApp-e-tax apps free for 30 days and have the option to choose whether they want the income tax version priced at R489 or the VAT and indirect taxes version for R379. Both apps together are available at a discounted price of R825. Users can upgrade or downgrade these versions at any time.

hApp-e-tax also offers corporate subscriptions where the employer pays for an annual subscription for its employees, who then get to download the app for free. hApp-e-tax can be contacted at info@hApp-e-tax.co.za for enquiries about corporate subscriptions or for bulk-free trials.