FinTech is great; it has gone a long way towards creating financial inclusion and banking the unbanked. However, most FinTech solutions require the users to connect to the given platform via the internet and most often via a mobile app or website.

Though smartphones penetration across Africa is pretty impressive, the cost of connecting to the internet is not so affordable, neither is it available or reliable at all places, all the time. You might have a smartphone, but when you travel upcountry, you will encounter poor to no internet connection. Then what good will the given FinTech solution be to you?

Then again, there is still a significantly large number of people who don’t own smartphones; 60% of mobile phone users are on feature phones. In such instances, FinTech solutions are as good conventional banking services; creating financial exclusion by being unavailable to the masses.

To truly achieve financial inclusion for everyone across the board, a good FinTech solutions should go beyond online presence in the form of mobile websites and apps, to include support for SMS and USSD transactions.

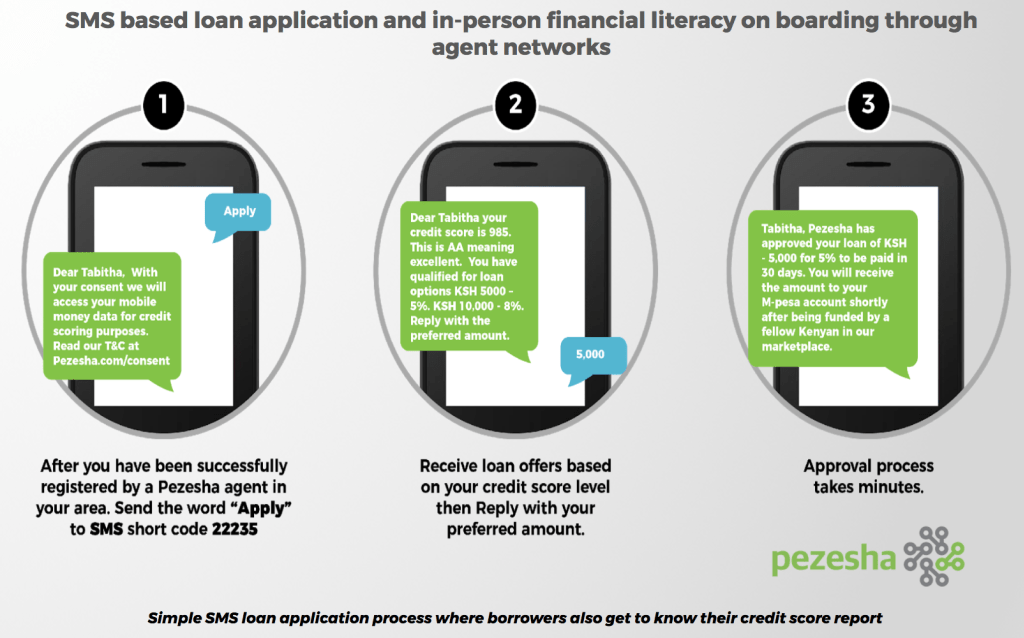

That is precisely what Kenya’s peer-to-peer lending platform, Pezesha, has upgraded to. Previously users had only the option of using the mobile app. The company has now launched a new platform, where users simply send the word ‘apply’ to short SMS code 22235 to get the loans instantly.

Tabitha, a Marketing Lead at Pezesha wrote on the company’s blog post: “We target low-income audience and currently at least 80% do not own a smartphone. Meaning they cannot access affordable financial services from their low-end phones.

Pezesha, therefore, aims to use this SMS channel to bring choice and financial inclusion to the more than 6 million excluded informal populations of micro businesses in Kenya. Most important use our agent networks across the country to enlighten our low-income households target on financial literacy that elevates them up the financial ladder.