Kenya is one of the cradle lands for mobile money spearheaded by M-Pesa by Safaricom. The success registered by the services has attracted other business people who came flocking into the fin-tech space in not just Kenya, but the continent as a whole.

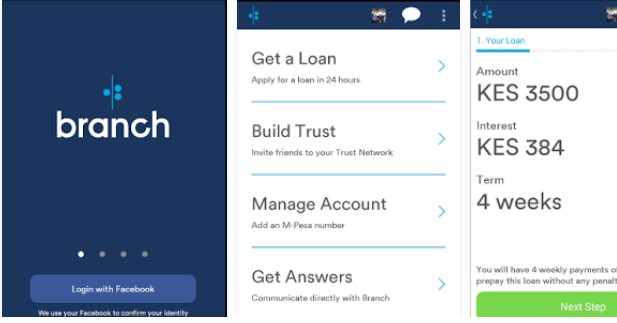

In Kenya, there are multiple lenders operating in the digital space of mobile money. They include Branch, Tala, Izwe, Pezesha, and Letshengo among many others; and guess what more are probably coming.

Well, lawmakers in Kenya have a bone to pick with these digital lenders operating on the mobile money platform. In case you don’t know, the government through the financial sector regulator, Central Bank of Kenya, has placed an interest cap on conventional money lending institutions such as banks.

However, it seems the same cap does not seem to exist for digital lenders. Now, lawmakers in Kenyan parliament wants the Central Bank to put in place and publish regulations governing the interest rates charged by the digital lenders. As per the record tabled before the Central Bank, there are at least 500 unregulated digital microlenders operating in the country.

The National Assembly’s Information, Communications, and Technology (ICT) committee is also proposing that the Central Bank’s interest cap be extended also to the digital microlenders.

As it works out, the digital microlenders will be required not to put their interest rate more than four points above the interest rate put in place by the Central Bank. The interest cap was put in place in 2016; much to the fury and disappointment of virtually all banks in Kenya.

Too many Microlenders on the Digital Mobile Money platform

There is a high proliferation of microlender in the digital money lending platform via mobile money. Some are charging interest as high as 200% with the lowest being somewhere around 18%, which is 4 points above the interest cap for a commercial bank that is currently at 14%.

The digital microlending industry has become so lucrative; no wonder the players exists in their hundreds. The sector is now more lucrative than the mainstream banking lending industry. The microlenders charge an annualized interest rate of between 18% to 200%. The loans are mostly short-term loans of between a day to a month at most.

According to research firm Financial Sector Deepening (FSD). People borrow these money for various reasons, but top of the chart include borrowing for betting, settle other loans, and pay school fees.

The FSD also established that despite the high-interest rates, these firms also lack transparency within. There are borrowers complaining of having been charged a fee they did not fully understand how it came by or sometimes did not expect at all.