Living paycheque to pay cheque is a harsh reality for 76% of hard-working South Africans. Techpreneur, Raeesa Gabriels, is shaking up the financial services industry by disrupting the conventional 30-day pay cycle and taking on exploitative payday lenders with her fintech solution, Level Finance.

Level Finance, Gabriels’ socially responsible daily money management platform, allows employees to build wealth through automated savings and access to pay when they need it – all before payday arrives.

Families are experiencing more month than money as the country battles the Covid-19 pandemic and with the economy in ruins. Many employees have had to take salary cuts or support additional households. They face ongoing financial hardship and are often forced to take a loan from unscrupulous micro money lenders and illegal loan sharks (mashonisas) – causing risk of financial ruin.

Gabriels, a 43-year-old mom of two, experienced the ramifications of extreme lending when her domestic worker was exploited by a ruthless loan shark who confiscated her ID book when she couldn’t keep up with his exorbitant interest rates.

Gabriels, a 43-year-old mom of two, experienced the ramifications of extreme lending when her domestic worker was exploited by a ruthless loan shark who confiscated her ID book when she couldn’t keep up with his exorbitant interest rates.

“She feared for her safety and had to flee her home,” says Gabriels. She felt compelled to come up with a solution to help her domestic worker and others who suffer the same fate.

“The earned wage access concept is being used by companies in the US and the UK with great success and I believed that we really need it here. Level Finance will get millions of South African employees out of debt and into a position of building wealth,” she explains.

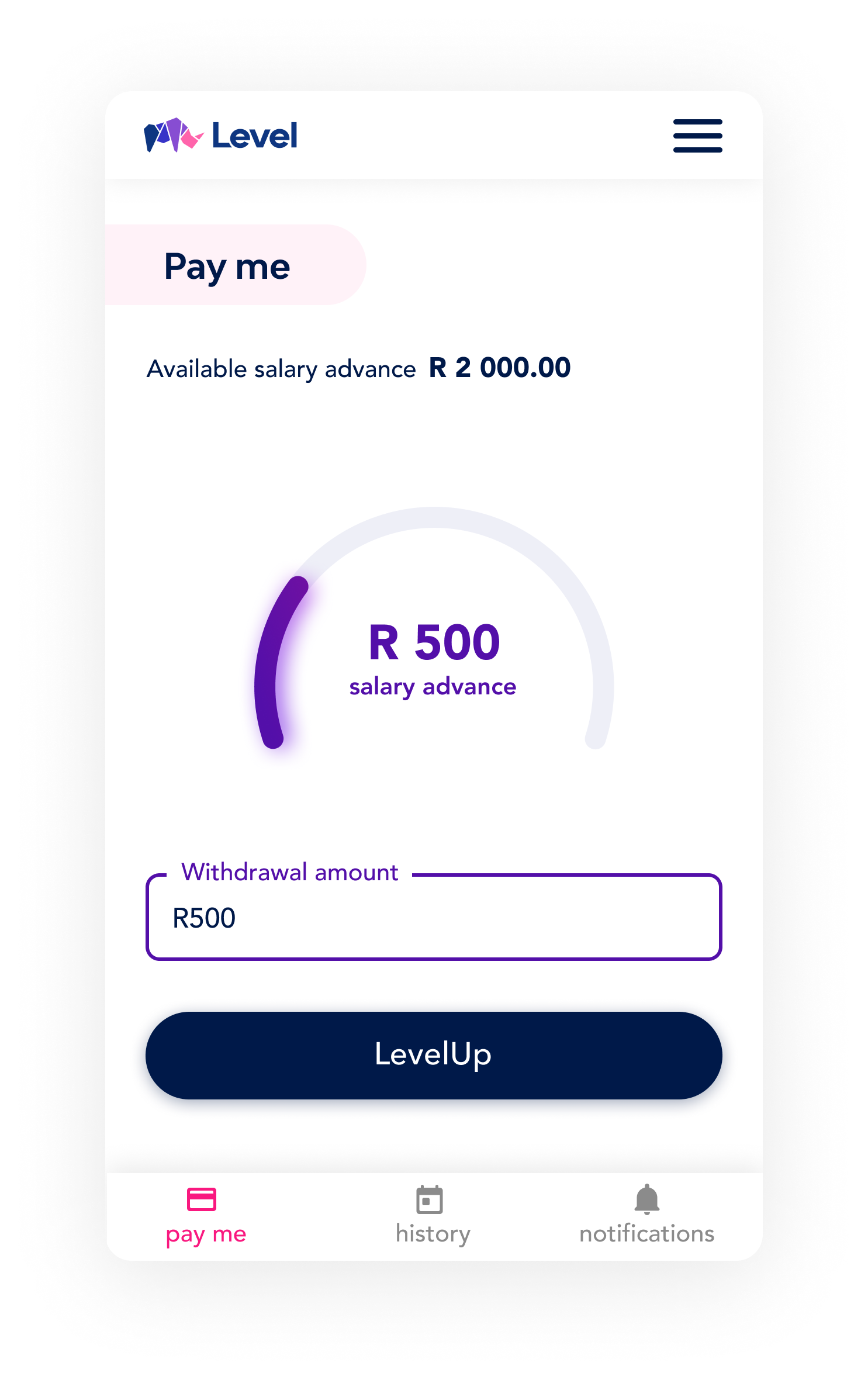

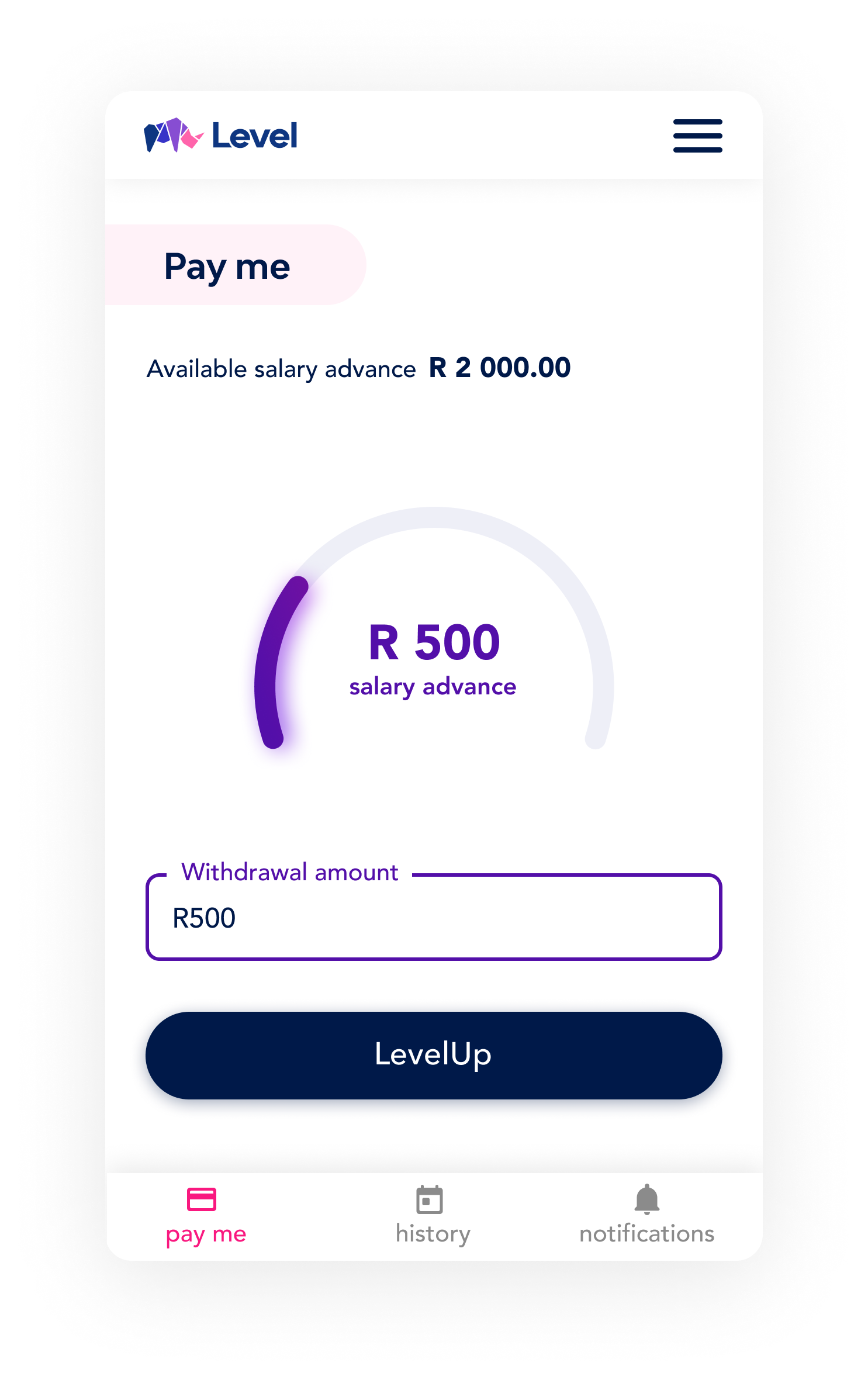

The platform enables employees to view their daily salary, offers access to their pay when they need it and the power to save before payday arrives.

Once an employer registers on Level Finance, employees can keep track of hours worked and money earned.

Level Finance charges a subscription fee to employees to keep the app operational, which is only paid when an employee accesses the service to withdraw their pay. Having access to money you’ve already worked for means you can afford unexpected expenses and won’t have to take out risky loans and pay exorbitant interest.

“When engaging with employers and employees, we found there’s a genuine need for our solution. We’ve demonstrated tangible results for both,” says Gabriels.

Apart from pioneering the earned wage access industry in the country, Gabriels is also the only black female CEO operating in this space. The impressive platform earned her a lucrative 12-month mentorship opportunity with the prestigious AlphaCode Incubate program, which only backs disruptive, groundbreaking businesses that make a meaningful impact on the financial services industry.

Says Dominique Collett, head of AlphaCode: “South Africans are generally poor savers and tend to live above their means living with high levels of indebtedness. Level Finance allows workers access to money they have already earned to keep them away from loan sharks. This offering is a welcome solution to a gap in the South African financial services landscape.”

However, any disruptive idea is bound to attract competitors. Since Gabriels started Level Finance and entered the AlphaCode incubator program, several new players have entered this space. But Gabriels and her team remain undeterred.

“We are all trying to solve the same financial pain, which is a massive problem in the South African and African context. I’m all for competition, so that the industry incumbents can move people out of this debt trap and towards financial freedom.”