M-PESA – The Leading Mobile Money Transfer Services From Kenya

Whenever you hear of any news about a developing nation like Kenya, the last thing you would expect is to hear about cutting edge technology. You would be even more surprised to learn that Kenya is the home to the world’s leading mobile based money transfer system which has literally transformed million of lives and ways of doing business.

M-PESA is a service being provided by the leading Kenyan telecommunication company called Safaricom. It was first launched in Kenya through a partnership between Safaricom and Vodafone. Due to the big success it has experienced in Kenya, M-PESA is now being introduced to other countries such as Tanzania, Uganda, Rwanda, South Africa and Afghanistan.

M-PESA is a mobile money transfer service that enables individuals without bank accounts or access to banking facilities to send and receive money easily and in a secure manner. They use their mobile numbers as their bank account number. The payment process begins by a user depositing money into his account (mobile number) through an M-PESA agent, once the money has been deposited into his/her account the user can then send a given amount to another user’s number (payee). The payee will get an SMS notification of the deposit, and will go to an M-PESA agent and withdraw the fund (from the “mobile wallet” into local currency).

Thus an M-PESA user does not require a bank account to transact, his/her mobile number serves the same purpose. An individual may decided not to withdraw the funds instantly, but it would not be to his/her interest since the money held in the mobile wallet accrues no interest. The money will just be in the Safaricom secured account, waiting to be withdrawn or send to another payee. Hence Safaricom came up with yet another innovative product dubbed M-SHWARI. This enables the users to deposit the money in their M-PESA account into the M-SHWARI account.

The M-SHWARI account now operates like a bank account, where money stored accrues interest over time based on a certain percentage. Active customer can now even request for a small overdraft, if and when they need some extra cash that they will repay later at a small interest fee. M-PESA fund transfer can only occur between subscribers of the Safaricom network only. The network subscribers need to register their SIM cards for M-PESA to enjoy the full advantages of the services. Although money can still be sent to unregistered SIM cards, such SIM cards owners will not enjoy the full benefits and security of the M-PESA services.

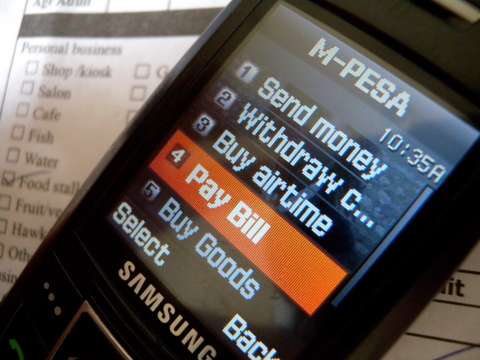

If money is sent to an unregistered M-PESA SIM number, the user will be given a one-time voucher number, which they can take to an M-PESA agent to enable them withdraw their money. If the unregistered user takes too long to withdraw the money, the fund send to him/her is reverted back to the payer. M-PESA now enables customers to pay for their utility bills such as electricity, water, Satellite TV subscriptions, buy airtime, pay for goods and services from various online stores among other retailers where M-PESA payment is accepted.

Another recent innovation by M-PESA is the “Lipa na M-PESA” service, which allows the users to pay using M-PESA for basic things they would normally pay using the local currency. This payment does not cost the user an extra cent than the amount the retailer is selling the goods/services at. The advantage of this is that now M-PESA users have the option of not carrying cash with them, as long as they have money in their M-PESA accounts, they can simply pay the vendor from their phone. This eliminates some of the dangers of operating with hard cash.

Comments are closed.