Creating a startup is one of the most exciting things a person can do. From securing business deals to making a profit, earning a good reputation online, and expanding. However, there are also downfalls, such as competitors poaching clients, and an advertising budget misused on the wrong agency. But, perhaps worst of all, are disasters that can jeopardize the survival of your business. Although, if you can prepare your business for a catastrophe, getting your company back on track will be a lot easier.

You’ll be interested to know that you’re one of the individuals in a small sector of startups who are thinking about setting up a plan to protect their business should the worst happen.

Startups and small businesses, in particular, are incredibly fragile and vulnerable to the effects of a disaster. Which is why it’s unsettling that many CEOs have no plan or money saved to get them through the other side of a catastrophe unscathed. To put this statement into perspective, according to the Federal Emergency Management Agency, 40% to 60% of small businesses shut down as a result of a disaster. Furthermore, out of the companies that are closed down for five days or more, 90% are gone within the year.

The intention here isn’t to frighten startups. More so, to enlighten them to the reality of startups and small businesses’ position in the grand scheme of disasters. But, of course, that isn’t to say that larger companies don’t feel the wrath of accidents and emergency occasions too. Take Compass Airlines, for instance, who have struggled due to the pandemic and, as a result, slipped into administration.

What Is A Disaster Preparation And Recovery Plan?

A disaster plan shall detail every avenue your business can and will exercise to overcome a catastrophic event. The top priority is people’s safety. Beyond this, your recovery plan can commence.

Although any disaster plan won’t do, it needs to be thorough, stress-tested, and reviewed to perfection for it to survive what the world has could throw at it.

For examples of potential disasters that have occurred, or could happen, here are a few examples;

Global pandemic

Tornado

Wildfire

Flood

Hurricane

Earthquakes

Disaster Plan Committee

If your business doesn’t already have one, piece together a dynamic, forward-thinking team, to organize a disaster plan for your business. Allow the group to vote on a leader, to make decisions, and push the project forward through to completion. Once you’ve assigned your team, you can delegate the objectives you want and need to complete. These are as follows;

Business Insurance

A necessity for all startup businesses, with premises, equipment, confidential company data, and staff, is insurance tailored to the business’s needs. After all, a hurricane, or flood could jeopardize all of the assets you have. And unless you have bank brimming with money to buy back all that’s lost, insurance is always a smart choice.

For a better understanding of what insurance packages are available for your company, ask the disaster plan committee to speak to an agent. Alongside noting down the available policy covers, and prices.

Administer a reasonable and affordable budget for your team to complete the assignment of securing and booking a good insurance company for your company.

Back-Up Power

Electric is the lifeblood that almost no business can do without. We’re in a world filled with technology. And honestly, most companies today wouldn’t be able to survive without computers, servers, scanners, telephones, and so forth.

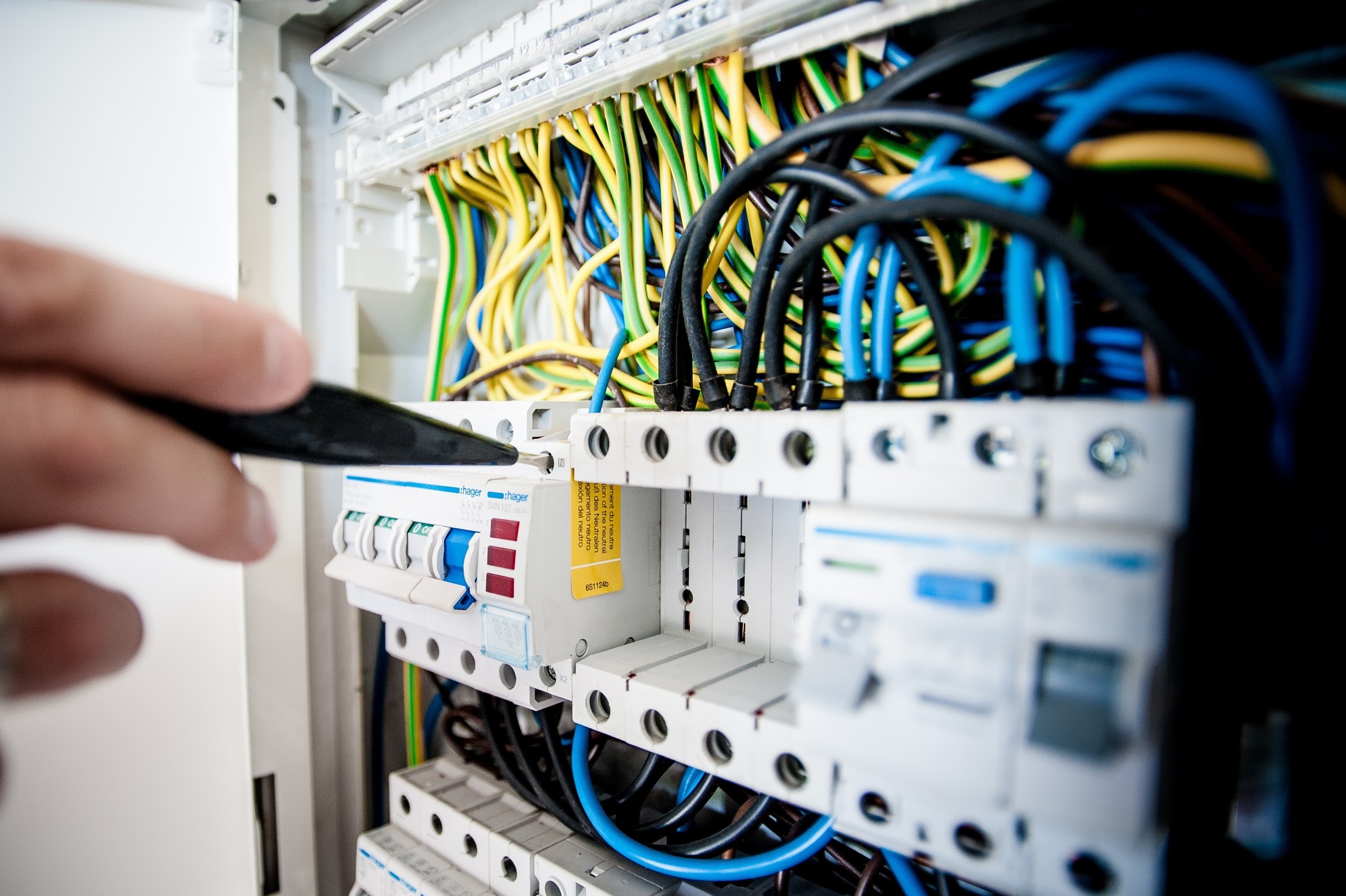

Picture by Pixabay from Pexels – CC0 Licence

It’s common for bad weather, such as storms, to cause a power outage, rendering your business useless until the town or city electricians can access and rectify the issue. However, if you invest in a backup generator from a professional electrical company such as Suncoast Energy, you could have your business back up and running in no time. Furthermore, having an agreement with an electrical contractor to handle emergency repairs on your work premises is also paramount for business.

Cloud Services

Speaking of power, if your business is mostly conducted with the use of the internet, there’s a company data backup procedure you must consider – it’s the cloud. If the technical equipment, PCs, and laptops are destroyed in your office, with your company’s data on the cloud, you have a backup. Meaning you’ve maintained your customers’ credentials, and you and your employees can also continue some of your company operations online.

Depending on the size and scale of your business data shall determine what cloud services are right for your company. IT management companies have servers on-site, in a different location to your own. Cloud service management companies can offer some of the following services which would benefit your business during a disaster;

Create an online platform to access projects anywhere in the world (providing you have an internet connection)

Creating accounts for each employee with restricted access on each login

Data protection from an IT solutions team that can prevent malicious spyware and viruses from infiltrating your data

Company data is regularly backed up to the main server away from your workplace.

Cloud services allow you and your employees to work from anywhere. Meaning, if your business premises are ruined, you can all still work from home and keep the business going. Moving more, or all of your business operations and data online is something worth requesting your disaster plan committee to implement into the recovery plan.

Emergency Funding

Although budgets tend to be tight and strict when launching a startup, be mindful of leaving a cushion of cash for your company to fall back on in hard times. Having a pot of money that can cover three to six months of business expenses will enable you to keep your business open and alive during a disaster.

For instance, various contractual routine payments shall leave your account regardless of whether a disaster is afoot. Such as rent for the premises, utility bills, marketing agency fees, employees’ wages, and so on.

A fallback fund shall also help bridge the gap between the disaster and the payout you should receive from your insurance company.

Also, in your absence, ensure you have trustworthy individuals who can access and use the emergency fund to pay for business expenses when needed.

Second In Command

It’s always essential for any business owner to teach someone to fill their shoes if and when the need arrives. You’ll probably already have an idea of who is fit for the role. If not, you’ll need someone dependable, resourceful, and calm under pressure.

Picture by Cytonn Photography from Unsplash – CC0 Licence

Your second in command will take over your duties, and so, ensure whomever you choose, is fully trained and equipped to do so. Be prepared to let them run the business from time to time, to get a real handle on how things will operate when you’re not around.

As you’ve probably noticed through this post, delegation is a running theme and necessity for creating a robust disaster plan. It will help if you put your trust and faith in others to come through when the business needs it the most. So long as you educate, train, and guide your employees, there shall be no issue that can’t be solved by your teachings or their improvisation.

Trial Runs and Stress Tests

Continuous rehearsing for a disaster plan, on spontaneous occasions, shall force you and everyone else to get into action and put the program created by your committee in motion.

All employees should know where the exits are, what to do in the event of any particular disaster that arrives, who the first-aiders are, who the planning committee are and so forth.

Of course, the contrast between a stress test and an actual disaster is very different. However, it certainly helps everyone to prepare for the worst.

During the testing phases, therein lies the opportunity to rejig and upgrade the plan as needed. It shall help to identify problems and holes in the plan that were not yet accounted for. In doing so, the committee can build a better plan, inclusive of the areas that were not considered. This process of upgrading the disaster plan should never end. By continuously searching for ways that the plan might fail, id where you will find an opportunity to make it better – and save your business from potential failure.

For additional guidance on how to begin preparing for individual disasters, refer to the Small Business Administration, which provides checklists detailing points to work through in the likely scenario of a particular emergency. Such as a hurricane, poor winter weather, a flood, and so forth.

As you’re aware, Covid-19 has an existing checklist for businesses to adhere to, including supporting sick employees to self-isolate and providing hand sanitizers around the workspace. And of course, supplying gear such as face masks and gloves to prevent transmission and infection of Covid-19.

To overcome a catastrophe, preparation and planning are necessary for any startup or small business to survive. If you have the time, work through the tips above and use the relevant parts for your business.

We always like to think we know what’s coming, but as this year has shown us, we certainly don’t. So it’s best for all startup businesses to prepare for the worst-case scenario, and rehearse it until it’s ingrained. If you devise an excellent plan, your company may overcome the challenges a disaster brings enough to thrive on the other side of it.